A Biased View of Clark Wealth Partners

The Clark Wealth Partners Diaries

Table of ContentsClark Wealth Partners Can Be Fun For AnyoneHow Clark Wealth Partners can Save You Time, Stress, and Money.What Does Clark Wealth Partners Do?The 2-Minute Rule for Clark Wealth PartnersFacts About Clark Wealth Partners RevealedClark Wealth Partners for DummiesThe Best Strategy To Use For Clark Wealth Partners

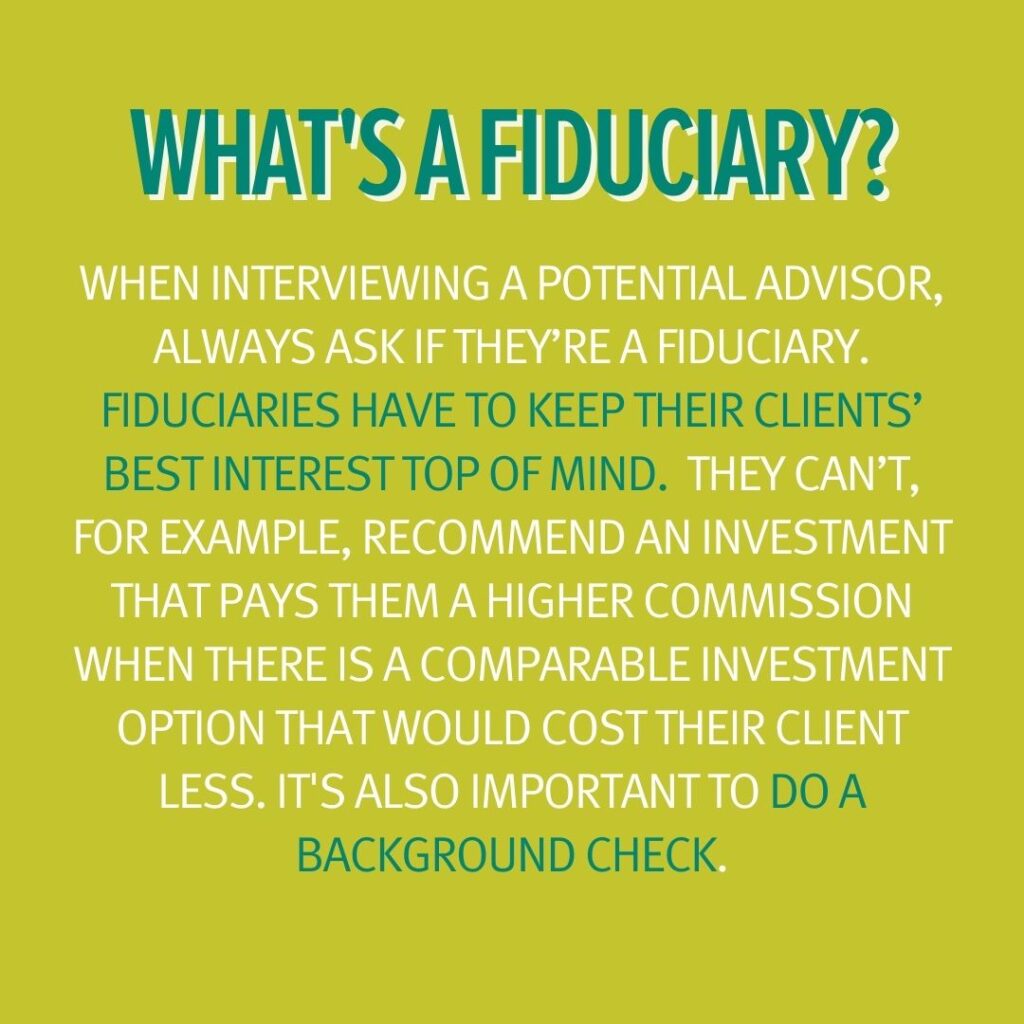

These are specialists who supply financial investment recommendations and are signed up with the SEC or their state's protections regulator. NSSAs can assist senior citizens make choices concerning their Social Security benefits. Financial consultants can likewise specialize, such as in student car loans, senior demands, tax obligations, insurance and other elements of your funds. The accreditations required for these specializeds can differ.Just economic consultants whose designation calls for a fiduciary dutylike licensed financial organizers, for instancecan say the very same. This distinction likewise implies that fiduciary and financial expert cost structures vary also.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

If they are fee-only, they're most likely to be a fiduciary. If they're commission-only or fee-based (suggesting they're paid using a combination of costs and commissions), they might not be. Numerous qualifications and designations call for a fiduciary obligation. You can inspect to see if the professional is registered with the SEC.

Choosing a fiduciary will ensure you aren't steered toward specific investments due to the compensation they use - financial company st louis. With lots of cash on the line, you might desire an economic specialist that is legally bound to use those funds thoroughly and only in your benefits. Non-fiduciaries might suggest investment products that are best for their wallets and not your investing goals

The Main Principles Of Clark Wealth Partners

Increase in cost savings the typical household saw that worked with a monetary expert for 15 years or more compared to a comparable household without a monetary expert. "More on the Worth of Financial Advisors," CIRANO Job Information 2020rp-04, CIRANO.

Financial advice can be useful at transforming factors in your life. When you meet with an advisor for the very first time, function out what you desire to obtain from the advice.

The Clark Wealth Partners Statements

As soon as you've accepted go ahead, your financial adviser will prepare a financial plan for you. This is offered to you at an additional conference in a record called a Declaration of Guidance (SOA). Ask the consultant to discuss anything you don't understand. You should always really feel comfortable with your adviser and their suggestions.

Insist that you are informed of all transactions, and that you receive all document pertaining to the account. Your consultant might suggest a taken care of optional account (MDA) as a way of managing your financial investments. This includes signing an agreement (MDA agreement) so they can get or sell financial investments without having to talk to you.

All about Clark Wealth Partners

To shield your money: Do not give your advisor power of lawyer. Insist all communication about your financial investments are sent out to you, not simply your consultant.

This may happen throughout the conference or online. When you enter or renew the recurring cost arrangement with your adviser, they should explain exactly how to finish your connection with them. If you're relocating to a new advisor, you'll need to organize to transfer your monetary records to them. If you need help, ask your adviser to explain the procedure.

will certainly retire over the next decade. To load their shoes, the country will require greater than 100,000 brand-new economic consultants to go into the market. In their day-to-day work, economic advisors manage both technological and innovative tasks. United State News and Globe Record rated the role among the top 20 Best Business Jobs.

Indicators on Clark Wealth Partners You Need To Know

Assisting people accomplish their economic goals is an economic consultant's key feature. They are additionally a small company proprietor, and a part of their time is devoted to managing their branch workplace. As the leader of their technique, Edward Jones economic experts require the leadership skills to work with and take care of team, as well as the business acumen to create and perform a company technique.

Spending is not a "set it and forget it" task.

Financial advisors should set up time each week to satisfy new individuals and catch up with the Your Domain Name people in their round. Edward Jones monetary advisors are privileged the home workplace does the heavy training for them.

Clark Wealth Partners for Dummies

Proceeding education is a needed part of preserving a financial expert permit (financial company st louis). Edward Jones economic advisors are motivated to seek added training to broaden their understanding and abilities. Dedication to education safeguarded Edward Jones the No. 17 area on the 2024 Training APEX Honors checklist by Training magazine. It's also a great concept for economic advisors to go to sector seminars.